Margins

Introduction for margins

Introduction to Margins: Leveraged Accounts

here are two types of leveraged accounts and they can upgraded or downgraded at any time: Reg T Margin and Portfolio Margin.

The account type is chosen during the account opening process.

The Portfolio Margin accounts require a lower level of margin (more leverage) for securities than the Reg T Margin account. However, for some portfolios, the Portfolio Margin account's leverage will be lower due to high levels of risk, because while the Portfolio Margin's margin calculation takes into consideration the portfolio level of risk based on all of the positions, the Reg T Margin's calculation is per position.

Investors can compare their current margins of their investment portfolios with those of a Portfolio Margin account by pressing the "TRY PM" button in the Account Window in the trading platform.

Securities margins are different from those of commodities. While securities margins are the amount of cash that the investor borrows, the commodities margins are the amount of cash that the client must "put aside" in order to maintain the positions.

The Definition of Margin for securitiesIn reference to securities, the definition of margin includes three important terms:

The margin loan - The margin loan is the amount that the investor borrows from the broker in order to purchase the securities.

The margin deposit - the margin deposit is the amount of equity that was contributed by the investor in order to purchase the securities in a leveraged account.

The margin requirement - the margin requirement is the minimal amount that the investor needs to deposit, and is expressed as percentages of the current market value of the transaction.

The deposit can be bigger or equal to the margin requirement. As seen in the following equation:

Margin Loan + Margin Deposit = the Market Value of the Transaction

Margin Requirement =/< Margin Deposit

If an investor is interested in trading on margin, he must first open a margin account and sign all of the related agreements. While trading on margin, an investor must always abide by the brokers’ margin rules and demands. failure to do so may require the client to deposit more funds or close a part or all of his positions.

"Initial Margins" and "Maintenance Margins"

The Federal Reserve and the self-regulatory organization (SRO's), such as NYSE and FINRA, have clear rules as to leverage trading. While trading with an American broker, the "Regulation T" law allows investors to borrow up to 50% of the value of purchased securities. The cash amount that the investor has to pay for the securities is called "Initial Margin".

The second type of margin is called "Maintenance Margin". Regulation requires every leverage account to hold a maintenance margin of at least 25% of the investor securities value. Day traders in the US markets have a minimum requirement of at least $25,000 or 25% of the securities value in the account if it exceeds $25,000.

If at any time an account drops below the maintenance margin requirement, the client must deposit funds to the account, or close some of his positions. , the broker might randomly close some of the positions in the account.

The brokers can also define their requirements for minimal margins, which are called "the house requirements". Certain brokers choose to ease the terms of the loan more than others, and the terms of the loans may change from one client to the other. However, the brokers must always act in the course of the parameters of the margin requirements which were set by the regulators (such as FINRA). Not all securities can be leveraged.

Buying with leverage might be a "double edged sword" that can translate into bigger profits or bigger losses. In the volatile markets, investors who borrowed from their broker, may need to supply additional margin if the price of the share changes fast. In these cases, the broker might change the margin requirements after sending a warning email. This is why monitoring your account while trading on margin is very important.

The Definition of Leveraged Commodities

The margins for commodities are the amount of equity that was contributed by the investor in order to support the futures.

The margin requirement for futures and future options are calculated according to an algorithm that is known as SPAN. SPAN (the analysis of a regular leveraged portfolio) estimates the risk in the portfolio by calculating the worst case scenario that a diversified portfolio may reasonably lose throughout a defined period of time (Usually one day). This is done by calculating the profits and the losses that may happen in different market conditions. The most important part in the methodology of the SPAN is the array of risk, which is a set of numeric values that estimates how a certain futures shall profit or lose under certain conditions. Each scenario is called a "risk scenario".

Initial Margins and Maintenance Margins for Commodities

Just like securities, commodities also have initial margins and maintenance margins. These margins are usually set by the exchanges as a percent from the futures which is based on the volatility and the price of the futures. The initial margin requirement for futures is an additional amount that an investor has to put as collateral in order to open a position. In order to be able to buy futures, an investor must meet the initial margin requirement.

Commodities maintenance margin is the amount an investor must maintain in his account in order to support the futures, and it represents the lowest value to which the account can reach before the investor needs to deposit additional funds. Commodities positions are checked on a daily basis, and the account is adjusted to each profit or loss that occurred. Since the price of basic commodities changes, it is possible that the value of the commodities may decline to a point that the balance of the account descends below the required value for maintenance. In such a case, the broker may close some of the positions in the account.

Real Time Margins

Interactive Brokers uses real time margins in order to allow the investor to know and control the account level of risk. The margin system checks the required margin for the account every few seconds and takes new and existing positions under consideration, in order to prevent loses from the investor's side as well as from the broker's side, which allows IB to take such low commissions.

One can check your required margins at any time from the Account Window on the trading platform.

Universal Accounts

Your account allows you to trade in securities and commodities/futures on the same account. Therefore, it is composed of two accounts; the securities account; which is subject to the rules of the U.S. Securities and Exchange Commission (SEC), and a futures account; which is subject to the laws of the US Commodity Futures Trading Commission (CFTC).

If you have assets in the securities account or in the futures account, these assets are protected by the U.S. law and by the federal regulations that determine the manner in which the brokers must protect the property and the funds. In your securities account, your assets are protected by the laws of SEC and SIPC, and in your futures account your assets are protected by the laws of CFTC, which demand that the funds of the client be separated from the broker private capital.

As part of our client service, all accounts in Interactive Brokers are authorized to automatically transfer the needed funds between the securities account and the futures account in order to control your margin needs. In the page "Excess Fund Sweep" in account management you can define how you want Interactive Brokers to handle the transfer of excess funds between the accounts.

Margin Requirement Models

The most common model for margin is the "Reg T Margin" account which considers every position as an individual position, meaning that the margin is calculated per position, with the exception of option strategies.

The second model is the "Portfolio Margin" account which calculates a level of risk for all of the positions in the account. Therefore, if you buy a stock from a certain sector and sell another stock from the same sector, the margin calculation might take that into effect and lower the margin requirements for the two positions.

Other models are used in different situations. For example, if a certain stock is highly volatile, shorting it might require more than 100% of the value of the trade due to other fees that the investor need to pay to keep the position (borrow fee for example).

Margin calculation for securities

Calculating Margins for Securities in Reg T Margin Accounts:

The calculation of margins for Reg T accounts are described below. For additional details about Portfolio accounts, press on "Portfolio Margin" on the right side menu

We implement the calculations of margins in the "Reg T" accounts for securities in the following manner:

It is important to remember that the calculation of the securities that we perform in the preliminary "Reg T" accounts are performed at the end of the day (at 15:50 EST) as part of Interactive Brokers' Special Memorandum Account (SMA). We perform the calculations of margins in real time and throughout the trading day.

In addition, in order to understand the closure of transactions by IB you can use the following calculations:

The margin information can be found in "Account Window" in the trading platform

Calculating the Margins in regards to the trading time:

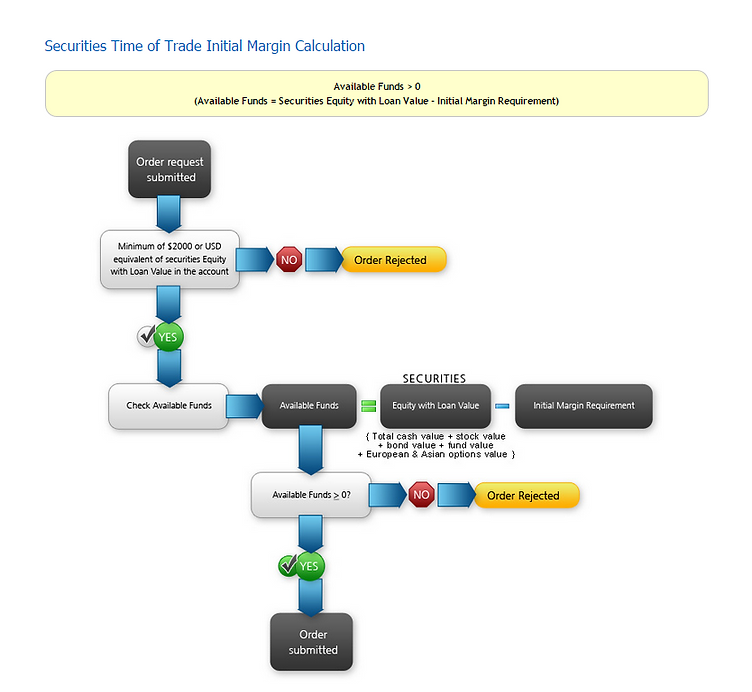

While opening a new position we implement:

• The preliminary and minimal requirement for equity.

• Examining the leverage for existing transactions.

The minimal margin requirement:

To open a new position in a leveraged account, you are required to have a minimum amount of $2,000. If you don't meet this preliminary requirement, than you can't open a new position.

Initial margin calculation time:

Upon a submission of an order, a real time check of the funds that are available in the account is conducted. The order shall be executed if there is enough available money in the account. The amount of available funds must be larger than the initial margin requirement.

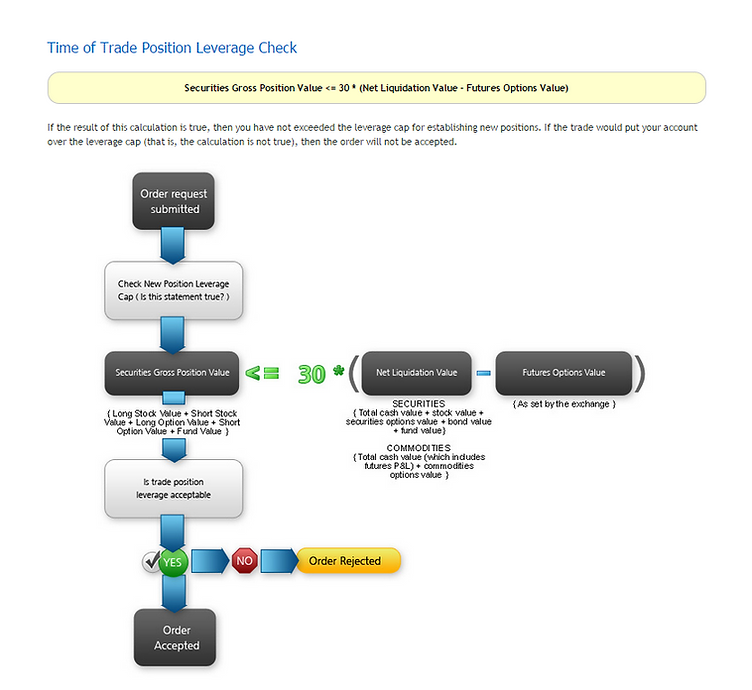

We perform the following calculation in order to guarantee that the value of the transactions will not exceeds 30 times more than the value of the liquidity minus the value of future options.

Calculating the Margins in real time

Throughout the trading day, we execute different calculations in real time regarding the margins in your account. These are the calculations that are performed for the margins during the trading time:

• Real-Time Maintenance Margin Calculation

• Real-Time Position Leverage Check

• Real-Time Cash Leverage Check

• Real-Time SMA Calculation

• Soft Edge Margining (SEM)

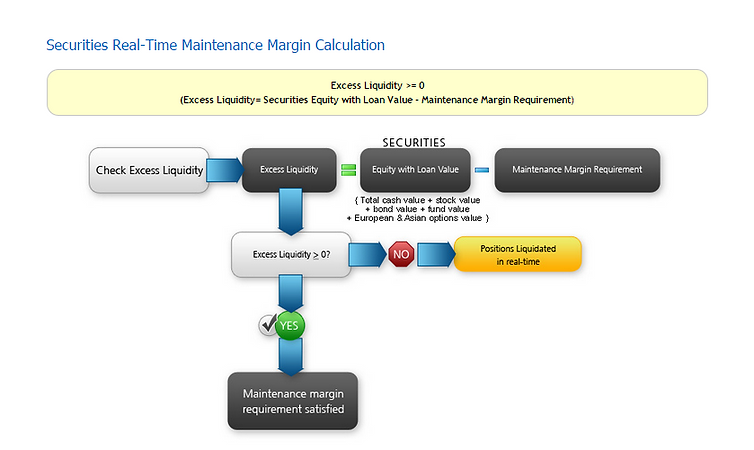

Real-time maintenance margin calculation

Interactive Brokers' Real-Time Maintenance Margin calculations for securities is pictured below. The maintenance margin used in these calculations is the maintenance margin requirement, which is listed on the product-specific Margin pages. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity.

Real-Time Gross Position Leverage Check

You can examine the leverage in real time in order to guarantee that the securities gross position value doesn't exceed the net liquidation value minus the future options value by more than 50 times. This limitation is designed to limit the risks that are involved in large transactions.

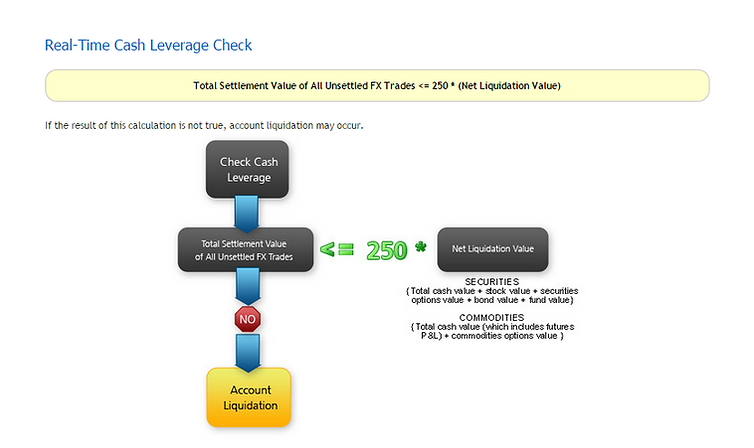

Real-Time Cash Leverage Check:

An additional leverage check on cash is made to ensure that the total FX settlement value is no more than 250 times the Net Liquidation Value as shown below.

Decreased Marginability Calculations:

Another examination of the leverage over the cash is performed in order to guarantee that the total FX is no more than 50 times the net value of liquidity as it is presented below:

Decreased Marginability Calculations:

We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding (SHO) of a company. For Margin securities accounts, this algorithm increases the margin requirement for stock positions exceeding 1% of the published SHO from its default to 100% (in other words, decreases the amount of money that can be borrowed against a stock position toward zero). At 5% concentration, positions have a 100% margin requirement.

Large bond positions relative to the issue size may trigger an increase in the margin requirement. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Less liquid bonds are given less favorable margin treatment.

SEM:

We will automatically liquidate when an account falls below the minimum margin requirement. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin (SEM) during the trading day. From the start of the trading day until 15 minutes before the close of the trading day, Soft Edge Margin allows for an account's margin deficit to be within a specified percentage of the account's Net Liquidation Value, currently 10%. When SEM ends, the full maintenance requirement must be met. When SEM is not applicable, the account must meet 100% of maintenance margin.

Soft Edge Margin start time of a contract is the latest of:

• the market open, the latest open time if listed on multiple exchanges;

• or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Soft Edge Margin end time of a contract is the earliest of:

• 15 minutes before market close, the earliest close time if listed on multiple exchanges;

• or 15 minutes before the end of liquidation hours;

• or the start of Reg T enforcement time.

If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. This allows a customer's account to be in margin violation for a short period of time. Soft Edge Margin is not displayed in Trader Workstation. Once the account falls below SEM however, it is then required to meet full maintenance margin.

SMA and the Calculations of the End of the day

Real Time SMA

On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account (SMA). We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis.

Calculations of End of day SMA

As described above, we calculate SMA in real time throughout the trading day, but we enforce Regulation T initial margin requirements (typically 50% for stocks) at the end of the trading day. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day (15:50-17:20 ET), to ensure that it is greater than or equal to zero.

We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Note that this is the same SMA calculation that is used throughout the trading day. In the first calculation, "today's trades initial margin requirements" are added for SELL orders and subtracted for BUY orders, and are based on US Regulation T Initial Margin requirements.

The SMA laws:

The SMA is calculated according to the following rules:

• Cash deposits are credited to SMA.

• Cash withdrawals are debited from SMA.

• Dividends are credited to SMA.

• Trades are netted on a per contract per day basis:

- Realized pnl, i.e. day trading pnl are posted to SMA.

- Commission and tax are debited from SMA.

- All trades (one per contract) are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. The current price of the underlying, if needed, is used in this calculation.

- Option sales proceeds are credited to SMA.

- Premiums for options purchased are debited from SMA.

- The change to SMA resulting from trades is effectively the change in RegTEquity minus the change in RegTMargin.

• Universal transfers are treated the same way cash deposits and withdrawals are treated.

• Market appreciation: If Reg T Excess of a margin account is greater than SMA at the close (normally 16:00 US/Eastern), SMA is set to equal to Reg T Excess. Note that SMA balance will never decrease because of market movements. Reg T Excess = 0 or (RegTEquity - RegTMargin), whichever is greater.

• Currency trades do not affect SMA.

• Fees, such as order cancellation fee, market data fee, etc. do not affect SMA.

• Exercises and assignments (EA) are reported to the credit manager when we receive reports from clearing houses. They will be treated as trades on that day. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. Exercise requests do not change SMA. DVP transactions are treated as trades.

Overnight Margin Calculations

Stocks have additional margin requirements when held overnight. For overnight margin requirements for stocks, click the Stocks tab above.

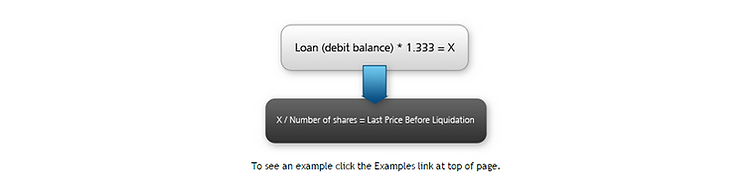

How to determine the last stock price before we begin to liquidate the position?

Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Note that this calculation applies only to single stock positions.

How many stock do we liquidate?

As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity (margin excess) in your Margin account in real time. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero.

You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Note that this calculation applies only to stocks.

margin calculations for commodities

We apply margin calculations to commodities as follows:

You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation (TWS).

Time of Trade Margin Calculations

When you open a new position, we apply the following:

• Initial Minimum Equity Requirement

• Time of Trade Initial Margin Calculation

Initial Minimum Equity Requirement

You are required to have a minimum of $2,000 or USD equivalent of commodities Net Liquidation Value to open a new position.

In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received.

If you do not have the minimum of $2,000 or USD equivalent of commodities Net Liquidation Value, or if you cannot satisfy the initital minimum equity requirement with assets in another currency, or if there is not enough cash in your securities account to satisfy the requirement, you will be unable to open the new position in your commodities account.

Time of Trade Initial Margin Calculation

Upon submission of an order, a check is made against real-time available funds. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. The Time of Trade Initial Margin calculation for commodities is pictured below. The initial margin used in this calculation is set by the individual exchanges and listed on the Futures & FOPs Margin page.

Real-Time Margin Calculations

Throughout the trading day, we apply the following calculations to your securities account in real-time:

• Real-Time Maintenance Margin Calculation

• Soft-Edge Margining

Interactive Brokers' Real-Time Maintenance Margin calculation for commodities is shown below. The maintenance margin used in this calculation is set by the individual exchanges and listed on the Futures & FOPs Margin page. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity.

In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house (e.g. HKFE HSI Options), but we may choose to margin these options on a premium style basis.

SEM:

We will automatically liquidate when an account falls below the minimum margin requirement. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin (SEM) during the trading day. From the start of the trading day until 15 minutes before the close of the trading day, Soft Edge Margin allows for an account's margin deficit to be within a specified percentage of the account's Net Liquidation Value, currently 10%. When SEM ends, the full maintenance requirement must be met. When SEM is not applicable, the account must meet 100% of maintenance margin.

Soft Edge Margin start time of a contract is the latest of:

• the market open, or the latest open time if listed on multiple exchanges;

• or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Soft Edge Margin end time of a contract is the earliest of:

• 15 minutes before market close, or the earliest close time if listed on multiple exchanges;

• or 15 minutes before the end of liquidation hours.

If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. This allows a customer's account to be in margin violation for a short period of time. Soft Edge Margin is not displayed in Trader Workstation. Once the account falls below SEM however, it is then required to meet full maintenance margin.

Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility.

Real-Time Liquidation

Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Before we liquidate, however, we do the following:

• We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met.

• To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. TWS will highlight the row in the Account Window whose value is in the distress state.

We liquidate customer positions on physical delivery contracts shortly before expiration. Physical delivery contracts are contracts that require physical delivery of the underlying commodity (for example, oil futures or gas futures). Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Certain contracts have different schedules.

50% Margin Benefit

Some futures products are margined at 50% of the normal margin requirements during normal liquid trading hours for each product type. Each day at 15 minutes before the close of the normal trading session for a product, margin requirements will revert back to the 100% requirement until the opening of normal trading hours the next day. Margin requirements will always be applied at 100% for all spread transactions.

For a complete list of products that we margin at 50%, see the Futures - Intraday Margin Requirements page under the Futures & FOPs tab above.

Portfolio Margin

Under SEC-approved Portfolio Margin rules and using Interactive Brokers' real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. For decades margin requirements for securities (stocks, options and single stock futures) accounts have been calculated under a Reg T rules-based policy. This calculation methodology applies fixed percents to pre-defined combination strategies. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. This model, known as the Theoretical Intermarket Margining System ("TIMS"), is applied each night to U.S. stocks, OCC stock and index options and U.S. single stock futures positions by the federally-chartered Options Clearing Corporation ("OCC") and is disseminated by the OCC to participating brokerage firms each night. The minimum margin requirement in a Portfolio Margin account is static during the day because the OCC only disseminates the TIMS parameter requirements once per day.

However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Please note, at this time, Portfolio Margin is not available for U.S. commodities futures and futures options, U.S. bonds, Mutual Funds, or Forex positions, U.S. regulatory bodies may consider inclusion of these products at a future date.

Portfolio or risk based margin has been utilized for many years in both commodities and many non-U.S. securities markets, with great success. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Trading with greater leverage involves greater risk of loss. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks.

Portfolio Margin Eligibility

Customers must meet the following eligibility requirements to open a Portfolio Margin account:

• An existing account must have at least USD 110,000 (or USD equivalent) in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account (in addition to being approved for uncovered option trading). Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. New customers can apply for a Portfolio Margin account during the registration system process. It should be noted that if your account drops below USD 100,000 you will be restricted from doing any margin-increasing trades. Therefore if you do not intend to maintain at least USD 100,000 in your account, you should not apply for a Portfolio Margin account.

• New customer accounts requesting Portfolio Margin may take up to 2 business days (under normal business circumstances) to have this capability assigned after initial account approval. It should be noted that if your account is subsequently funded with less than USD 100,000 in Net Liquidation Value (or USD equivalent), you will be restricted from doing any margin-increasing trades until the Net Liquidation Value exceeds USD 100,000. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Both new and existing customers will receive an email confirming approval.

• Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,000,000 (or USD equivalent).

• Customers in Canada are not eligible for Portfolio Margin accounts due to IDA restrictions. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products.

• Non-U.S. Omnibus Broker (Long Position/Short Position) accounts are not eligible for Portfolio Margin accounts

• Accounts reporting equity below the $100,000 minimum will be subject to a margin surcharge, the effect of which will be to gradually transition the account to margin levels approximating those of the Reg. T methodology as equity continues to decline.

Portfolio Margin Mechanics

Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Examples of classes would include IBM, SPX, and OEX. A product example would be a Broad Based Index composed of SPX, OEX, etc. A portfolio could include such products as Broad Based Indices, Growth Indices, Small Cap Indices, and FINRA Indices.

The portfolio margin calculation begins at the lowest level, the class. All positions with the same class are grouped and stressed (underlying price and implied volatility are changed) together with the following parameters:

• A standardized stress of the underlying.

- For stock, equity options, narrow based indices and single stock futures, the stress parameter is plus or minus 15%, with eight other points within that range.

- For U.S. market small caps and FINRA market indices the stress parameter is plus 10%, minus 10% as well as eight other points in-between.

- For Broad Based Indices and Growth indices the stress parameter is plus 6%, minus 8% as well as eight other points in-between.

• A market-based stress of the underlying. A five standard deviation historical move is computed for each class. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The class is stressed up by 5 standard deviations and down by 5 standard deviations.

• For Broad Based Indices the implied volatility factor is increased 75% and decreased by 75%.

• For all other classes, the implied volatility for each options class is increased by 150% and decreased by 150%

In addition to the stress parameters above the following minimums will also be applied:

• Classes with large single concentrations will have a margin requirement of 30% applied to the concentrated position.

• A $0.375 multiplied by the index per contract minimum is computed.

• The same special margin requirements for OTCBB, Pink Sheet and low cap stocks that apply under Reg T, will still apply under Portfolio Margin.

• Initial margin will be 110% of Maintenance Margin.

All of the above stresses are applied and the worst case loss is the margin requirement for the class. Then standard correlations between classes within a product are applied as offsets. As an example, within the Broad Based Index product 90% offset is allowed between SPX and OEX. Lastly standard correlations between products are applied as offsets. An example would be a 50% offset between Broad Based Indices and Small Cap Indices. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.

Interactive Brokers' real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power.

Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. We encourage those interested in Portfolio Margin to use Interactive Brokers' TWS Portfolio Margin Demo to understand the impact of Portfolio Margin requirement under different scenarios.

U.S stocks

This page contains the calculations of margins for a Reg T Margin Accounts. All margin requirements that are stated in this page are the minimum requirements.

The following tabulation shows the initial margins for stocks (while submitting the trade), the maintenance margins (while holding the stocks) and end of the day margins.

Long Position:

• The initial margins are 25% of the value of the securities.

• Maintenance margins are like the initial margins.

• The initial margins at the end of the day are 50% of the value of the securities.

• For cash account – 100% of the value of the securities.

Short Position:

• The initial margin is 30% of the value of the securities.

• Maintenance margins:

- 30% of the value of the securities if the price is higher than $16.67.

- $5 per stock if the price is higher than 5$ but lower than 16.67$

- 100% of the value of the securities if the price is lower than $5.

- $2.50 per stock if the price of the stock price is equal or lower than $2.50.

Special shares

We may reduce the collateral value of securities (reduces marginability) for a variety of reasons, including:

• small market capitalization or small issue size

• low liquidity in the collective primary/secondary exchanges

• involvement in tenders and other corporate action

Changes in marginability are generally considered for a specific security. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including bonds, derivatives, depository receipts, etc.

See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts.